Otherwise, these motorists "pay roughly the same yearly fixed costs for insurance coverage as an additional chauffeur with high annual gas mileage. Low gas mileage drivers would certainly have the best incentives to switch to pay-as-you-drive."Besides potentially saving cash for reduced gas mileage drivers, pay-as-you-drive insurance policy might provide a reward to drive much less - low cost. Explains Parry: "By increasing the low price of driving it would certainly affect people to drive a little bit much less - particularly for those with high threat aspects as reflected in high ranking variables (as they have greater insurance coverage costs per mile)."Parry includes that the advantage of this incentive to drive much less might prolong past the money conserved by customers with pay-as-you-drive insurance."There would be some modest take advantage of reducing opposite results from automobile usage - some modest reduction in carbon and local air exhausts and also traffic jam as aggregate vehicle miles driven is moderately decreased."Just how much is cars and truck insurance annually? Below's just how much the average motorist, with good credit report and a tidy driving document, would pay for the adhering to protection amounts, based upon Auto, Insurance coverage.

money vehicle laws insure

money vehicle laws insure

The typical price for 50/100/50 is - affordable auto insurance. The ordinary rate for 100/300/100, with thorough and crash as well as a $500 insurance deductible is. Bumping state minimum approximately 50/100/50 costs simply $129, so it's just around $11 a month-- Going to 100/300/100 from 50/100/50 costs, to increase your responsibility security.

These hypothetical motorists have tidy records and also excellent credit history. Ordinary prices are for comparative purposes. Your own rate will certainly depend on your individual elements as well as car.-- Michelle Megna added to this short article.

One of the biggest aspects for clients looking to get auto insurance coverage is the cost - automobile. Not just do costs differ from business to business, yet insurance policy expenses from one state to another differ too. According to , the average yearly expense of auto insurance policy in the USA was $1,633 in 2021 and is projected to be $1,706 in 2022.

How Much Does Car Insurance Cost On Average? - The Zebra Fundamentals Explained

Average rates differ extensively from state to state. Counting on typical automobile insurance coverage costs to approximate your automobile insurance policy costs may not be the most exact means to figure out what you'll pay.

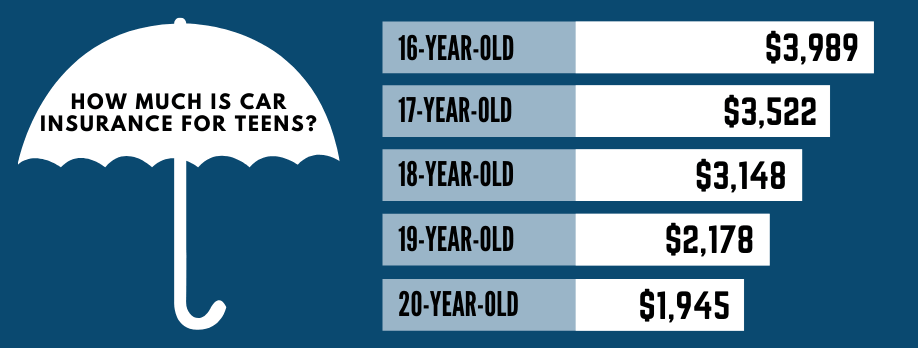

Insurance providers use numerous variables to figure out rates, as well as you might pay essentially than the ordinary vehicle driver for insurance coverage based upon your risk account. auto. As an example, more youthful motorists are usually more probable to get involved in a crash, so their costs are usually greater than average. You'll additionally pay even more if you have an at-fault crash, several speeding tickets, or a DUI on your driving document.

It might not provide ample defense if you're in a mishap or your automobile is harmed by an additional covered occurrence. Curious regarding just how the average cost for minimum insurance coverage stacks up versus the expense of complete insurance coverage?

money cheaper car insurance low-cost auto insurance insurance

money cheaper car insurance low-cost auto insurance insurance

The only way to recognize exactly how much you'll pay is to go shopping around and also get quotes from insurance providers. Among the variables insurance providers use to determine prices is location. People who reside in locations with higher burglary prices, accidents, and also all-natural catastrophes normally pay even more for insurance coverage. And also considering that insurance coverage legislations and also minimum coverage demands differ from state to state, states with higher minimum needs generally have greater typical insurance costs.

An Unbiased View of Most Expensive Cars To Insure - Benzinga

cheapest money vans car

cheapest money vans car

Many however not all states allow insurance coverage firms to make use of credit history when setting rates. In general, applicants with reduced scores are most likely to sue, so they usually pay a lot more for insurance policy than drivers with higher credit report. If your driving document includes mishaps, speeding up tickets, DUIs, or other offenses, anticipate to pay a higher premium.

Due to the fact that insurance policy business tend to pay even more claims in high-risk locations, prices are typically higher. Getting appropriate coverage might not be low-cost, yet there are methods to obtain a discount rate on your vehicle insurance policy.

If you have your home as opposed to renting it, some insurers will provide you a discount on your vehicle insurance premium, even if your house is guaranteed via another business. Besides New Hampshire and Virginia, every state in the country requires drivers to maintain a minimum amount of liability protection to drive lawfully.

It may be alluring to stick with the minimal restrictions your state requires to save money on your premium, yet you might be putting on your own at risk. State minimums are notoriously low as well as can leave you without ample security if you remain in a significant mishap. Many specialists suggest keeping enough protection to shield your assets.

8 Simple Techniques For Car Insurance Coverage Calculator - Geico

The amount you'll pay for vehicle insurance policy is impacted by a number of very different factorsfrom the type of coverage you have to your driving document to where you park your vehicle. You may likewise pay more if you're a new chauffeur without an insurance track record. The more miles you drive, the even more opportunity for crashes so you'll pay even more if you drive your car for job, or use it to commute long ranges.

Insurance providers usually charge more if young adults or young people listed below age 25 drive your automobile. Statistically, women often tend to enter into less accidents, have less driver-under-the-influence mishaps (DUIs) andmost importantlyhave less major mishaps than guys. All other things being equivalent, women commonly pay less for car insurance coverage than their male counterparts. auto insurance.

, as well as the types and amounts of plan choices (such as accident) that are sensible for you to have all influence exactly how much you'll pay for insurance coverage.

9 Easy Facts About The Pros And Cons Of Cybersecurity Insurance For Municipalities Described

Exactly How Much Is Car Insurance Policy each month? Vehicle drivers in the USA spend an average of $1,251 per year2 on car insurance, making the typical car insurance coverage expense per month $104. This typical rate is based on a complete coverage plan for a vehicle driver under 65 years old that has more than 6 years of driving experience and a tidy driving document.

We've made a credibility for integrity as well as trust fund, and we're honored to have a record of high customer scores for cases services. Elements Impacting Ordinary Automobile Insurance Coverage Expense per Month Not all motorists are the very same, so the typical cars and truck insurance price varies. If you reside in an area where your danger of being in a mishap is greater, your insurance policy prices might be higher.

Here are a few factors that will certainly affect your insurance quotes: Driving history Credit report Age Zip Code Automobile Insurance Firm Standard Monthly Price of Cars And Truck Insurance Policy by Vehicle Kind The kind of car you drive can likewise influence your auto insurance price. In many cases, auto insurance firms might charge much more for insurance coverage on certain kinds of lorries, consisting of: Possessing a cars and truck that is frequently swiped can suggest that your comprehensive insurance policy prices are higher.

These kinds of vehicles are usually a lot more pricey to fix if they are damaged. When it comes to deluxe vehicles, they're normally extra expensive to change if they're totaled from a car mishap (laws). Since these cars can travel at higher speeds, people might drive them quicker and be more most likely to enter a mishap or get a website traffic offense.

The smart Trick of Average Cost Of Car Insurance (With Quotes, Updated April ... That Nobody is Discussing

Chauffeurs under 25 have less experience when driving and researches reveal they trigger more crashes. 3 So, if you or a person on your policy is under 25 years old, your automobile insurance costs might be higher. Auto insurance rates might lower after a motorist turns 25, particularly if they have not had any type of at-fault crashes. insurance companies.

Normally, if you're over 25 but below 60 years of ages, your car insurance coverage expense each month will certainly be the most affordable. If you're not within that age variety, you can still discover means to save - auto insurance. We provide numerous unique rates and discount rates with the AARP Car Insurance Program from The Hartford.

If you have an AARP membership, get a vehicle insurance coverage quote today and save - insurance affordable. Just how Much Is the Average Auto Insurance Coverage per Month in My State?

One state's ordinary auto insurance coverage cost per month might be greater than another's because it requires motorists to have even more liability protection (car). On the other hand, an additional state might balance the least expensive automobile insurance each month due to the fact that it needs a reduced minimum insurance coverage. Tips to Save Money on Your Monthly Car Insurance Payment Contrast cars and truck insurance coverage quotes to ensure you're getting the most effective rate.

Getting My How Much Is Car Insurance? - The Balance To Work

You may desire to consider adding optional coverage so that you're fully covered. You can save up to 5% on your automobile insurance coverage and 20% on your residence policy with The Hartford. insurers.

Often Asked Concerns About Automobile Insurance Policy Expense How Much is Auto Insurance Policy for a 25-Year-Old? Relying on your vehicle insurance company and also the obligation protection you pick, a 25-year-old may pay even more or less than their state's average cars and truck insurance coverage price per month. When you transform 25, you ought to call your cars and truck insurance provider to see if you can save cash on your automobile insurance policy price if you have a good driving history. low cost.

You will certainly require to hold at the very least the minimum needed insurance coverage in instance of a crash. You might likewise choose for additional insurance coverage that will certainly enhance your rate, but additionally raise your security in the event of a mishap.

What Automobiles Have the most affordable Insurance Fees? When it concerns the typical auto https://s3.us-east-2.wasabisys.com/about-car-insurance-for-teens-and-new-drivers/index.html insurance cost monthly for various kinds of automobiles, vans typically have the least pricey insurance policy premiums. Sedans generally have the greatest vehicle insurance coverage cost per month, while sports energy vehicles as well as vehicles are priced in between.

Rumored Buzz on What Percentage Of Auto Insurance Customers Are Shopping ...

At What Age Is Vehicle Insurance the Cheapest? No issue your age, if you desire to reduce your auto insurance policy prices, you need to find a car insurance policy business that can use you discounts as well as advantages.

The response depends on a number of variables, consisting of where you live, exactly how much your car is worth, and what other assets you require to protect. Trick Takeaways Most states need you to have at the very least a minimal quantity of insurance protection for any type of injuries or property damage you create in a mishap.

Comprehensive insurance coverage, additionally optional, shields versus various other threats, such as burglary or fire. Without insurance motorist insurance coverage, mandatory in some states, safeguards you if you're struck by a driver that does not have insurance coverage. Just How Cars And Truck Insurance policy Functions A vehicle insurance coverage is actually a bundle of a number of different types of insurance policy. insurers.