When contrasting quotes, it's essential you contrast the exact same cars and truck insurance coverage between various companies. For instance, you'll desire to make certain the collision coverage is for the very same amount or has the very same deductible. This is essential due to the fact that one firm might appear like it's supplying affordable car insurance policy, but if they do not provide the very same coverage, it's not a reasonable comparison.

Here are the essential things to think about when you're taking a look at a vehicle insurance coverage: The amount you pay of pocket prior to insurance policy starts. Covers you if your car is in a crash, consisting of with an additional automobile, a things, or on its own (such as a rollover). Covers burglary, vandalism, or damage to your car that isn't covered by collision insurance.

May cover recovery expenses and lost incomes too. May additionally be called various other points by the company, yet it typically means insuring the distinction or some part of the difference between what you owe on a vehicle loan and also what your cars and truck is in fact worth. Generally covers any type of prices needed if you break down, such as towing, battery jump-start, puncture modification, and also extra.

Depending upon your individual choices, you may likewise intend to investigate any type of perks or benefits that come with an insurance coverage from a specific company. Some firms have excellent mobile apps, while others do not. As part of your research study, be sure to look at consumer insurance coverage testimonials and also client satisfaction ratings of any type of service provider you're thinking about (car).

: Those with a good driving record might get a lower rate at-fault accidents and also traffic infractions will certainly enhance your rates. The a lot more expensive your auto, the higher your rates will be.

The smart Trick of 10 Best Car Insurance Companies In New York Of 2022 That Nobody is Discussing

An excellent credit history score will assist you obtain lower rates. Specific companies use a price cut for trainees who earn great qualities or keep a particular GPA (cheap car).

For the quickest and most reliable way of finding the best prices, utilize an automobile insurance coverage comparison website. This will certainly take the problem out of exploring different insurance coverage items and also spending a great deal of time to locate your responses.

suvs cheap car insurance cheap car insurance cheaper car

suvs cheap car insurance cheap car insurance cheaper car

in its network. It can match you with personalized discounts as well as insurance coverage options. The site functions well on mobile and desktop computer internet browsers, and also you get cause less than 5 mins. Along with using Insurify to compare car insurance quotes, individuals can likewise compare residence, occupants, pet, and medical insurance quotes, all on the same contrast platform.

Results, When requesting quotes from Insurify, the site offered outcomes from 8 different business. It intends to simplify insurance coverage by providing you real-time quotes. You can get coverage no matter where you livethe site companions with even more than 30 leading carriers as well as offers quotes in all 50 states.

Get This Report about Best Car Insurance Companies - Youtube

Along with car insurance policy, the contrast website can assist you get a good deal on house, impairment, and occupants insurance. Policygenius offers chauffeurs an average rate savings of $435 per year on vehicle insurance policy. The site additionally asserts to save consumers approximately 35 percent when packing home as well as auto insurance with plans gotten on their platform (auto).

Deals quotes for packing your automobile as well as house insurance coverage, Does not display quotes in real time, Lengthy sign up process, While Compare. com isn't an insurance policy broker, it is an alternative for comparison-shopping online. The site states it collaborates with over 50 auto insurance provider to assist you locate the most effective price. accident.

The business's list of companions consists of All Internet Leads, Quote Wizard, Media Alpha, Hometown Quotes, and Avenge Digital. As well as here's the kicker: using this site implies you offer authorization for telephone calls and sms message even if you get on a "do not call" list. Exactly how Compare. com Functions, To obtain a quote on Compare.

low cost business insurance insurance laws

low cost business insurance insurance laws

When purchasing auto insurance through Contrast. com, individuals don't always obtain a quote. In this circumstances, no quotes were presented for any one of the insurance coverage levels. Contrast. com's quote listing only offered one advertisement for Allstate, inviting customers to get a quote from the insurance provider straight. Contrast. com sometimes provide quotes as opposed to ads, relying on your location.

Just How Quote, Wizard Functions, You can inspect prices from Quote, Wizard online or by phone. The on-line procedure asserts to give you a quote in a matter of minutes. You likewise have the option to talk to a representative by phone. Quote, Wizard requests the info you would certainly anticipate: lorry year and kind, existing insurance provider, day of birth, name, as well as address.

The Ultimate Guide To Car Insurance Companies - Compare And Save

They do not provide up much details on their group, tech, or other information that help legitimize their item. With a quick search, customers can see that Otto has actually obtained abhorrent evaluations for their service with many customers declaring that the internet site is a fraud to collect customers' individual details - vehicle insurance. Just How Otto Functions, Making use of the Otto product is reasonably easy.

Otto requires individuals to create an account in order to watch quotes. Outcomes, After finishing the brief questionnaire and also registering with the internet site, Otto provided absolutely no real quotes (low-cost auto insurance). Rather, it presented ads that redirect to other web sites, including for house as well as life insurance coverage quotes not exactly what individuals looking for auto insurance policy prices quote demand.

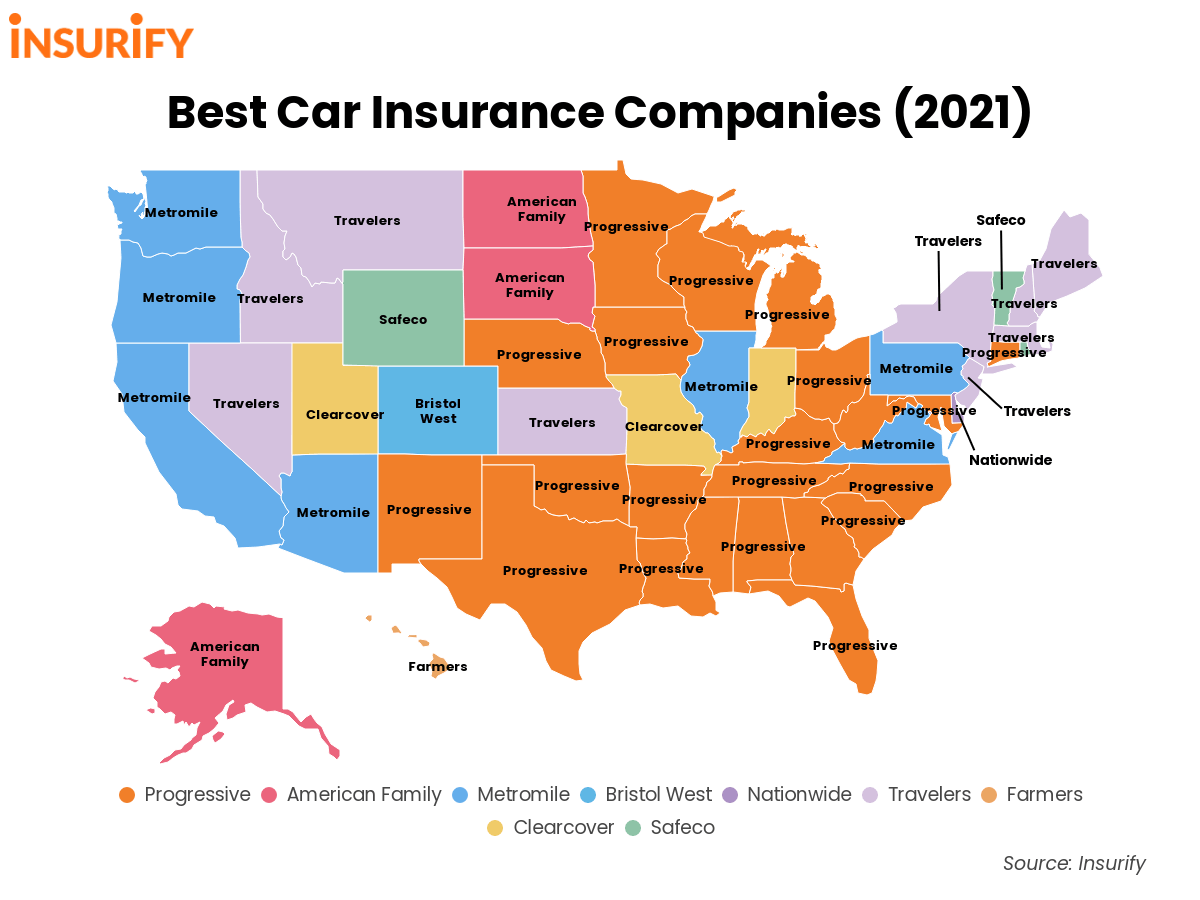

In every state, you have many cars and truck insurance coverage firms to select from-- and also nothing repays even more than contrast shopping. has actually built partnerships with a range of vehicle insurance policy carriers covering chauffeurs of all kinds, Go to this website from liked to high-risk. To make picking a automobile insurance policy business hassle-free, we did the hefty lifting for you and created an useful device that includes the ideal automobile insurance provider in the sector.

Whether you're looking for brand-new coverage or just wish to change cars and truck insurance companies, we've obtained you covered. Discover Business That Can Assist You.

Discovering the ideal car insurance protection can be discouraging. Every insurance provider claims to have the most affordable cost and also superior customer service, but they can not all be top. This evaluation takes a more detailed check out the 12 providers that came out on top, and also this listing might shift as we evaluate new companies as well as company details alter.

3 Simple Techniques For The 6 Best Car Insurance Companies (2022) - Valuepenguin

To qualify, you must belong to the armed solutions or have a parent, grandparent, or partner with a USAA membership.: A++ USAA often tends to use the lowest rates generally, making it among the very best auto insurer. credit score. Additionally, USAA has significant cars and truck insurance coverage price cuts for veterans.

The business provides some of the most affordable prices on the marketplace, as well as it is among the finest automobile insurance policy alternatives available nationwide.: A++ Common prices from Geico are between $1,000 as well as $1,600 per year. We have actually found Geico is less expensive than the ordinary price in a lot of states. If you can not get USAA, you'll probably find the best car insurance prices from Geico.

Auto Insurance Study. It ranked extremely in California, New England, and the Central region - affordable car insurance. Geico Pros Geico Cons A+ score from the BBB and also A++ economic stamina ranking from AM Ideal Typical quote experience Lots of options for protection High level of customer claims satisfaction Readily available in 50 states For more information about this cars and truck insurance company, take a look at our complete Geico evaluation.

All that equates into a discount rate, which is why we think State Ranch is the. auto. With State Farm, you can get basic automobile insurance plans as well as the following additional coverage:: State Ranch will cover up to one hour of labor at the failure site, fluid delivery, spare tire setup, jump beginnings, towing, and lockout solutions.

State Ranch has a B score from the BBB right now. Its consumer examines on the BBB website and Trustpilot are below average. In the J.D. Power 2021 United State Auto Insurance Study, State Ranch placed initially in Florida, New York, and the Northwest area. State Ranch Pros State Ranch Cons Comprehensive insurance coverage offerings Noted errors with autopay Extensive option of discounts Not offered for new consumers in Massachusetts or Rhode Island Easy online prices quote process Combined customer examines You can get approved for State Ranch's accident forgiveness program if you have actually had insurance policy with State Ranch for over nine years and also have actually not filed a case throughout that time.

New Market Car Insurance: Compare Cheap New ... - Jerry Fundamentals Explained

cheap cheaper auto insurance cheapest car cheap auto insurance

cheap cheaper auto insurance cheapest car cheap auto insurance

To find out more concerning this car insurance coverage supplier, take a look at our review of State Farm automobile insurance coverage - cheap insurance. # 4 Progressive: Best Cars And Truck Insurance Policy For High-Risk Drivers In fourth location in our finest cars and truck insurance policy contrast is Progressive. This firm has actually been around considering that 1937 and also introduced lots of insurance firsts over the years.

: Conserve by including one more sort of insurance to your plan with Progressive, such as condominium, occupants, or home insurance policy. Dynamic often tends to be a little bit a lot more cost effective than Geico for motorists who have a DUI/DWI on their document - insurers. This is why our team believe it uses the best high-risk automobile insurance.

Progressive also does not have client fulfillment scores as high as those for USAA or GEICO. vans. Dynamic Pros Modern Cons Among the leading auto insurance firms in the United States Typical cases process A+ financial toughness score from AM Best Mixed consumer service testimonials Outstanding selection for high-risk motorists Numerous money-saving features To read more about this cars and truck insurance coverage provider, look into our review of Progressive automobile insurance policy.

As soon as you are a AAA participant, insurance coverage costs can differ by region yet often tend to be affordable with other insurance companies. Along with basic auto insurance policy, AAA offers the adhering to auto insurance protection choices:: All AAA vehicle insurance policyholders are required to carry AAA roadside aid coverage, which is extensive. vehicle.

: With this coverage, AAA will certainly pay for a brand-new automobile replacement if your auto is totaled.: Space insurance covers the distinction between your impressive finance and also the amount your crash insurance coverage offers after a total loss (risks).: This alternative guarantees that only original equipment manufacturer (OEM) components will be used in repairing the outside of your automobile.

Little Known Questions About State Farm Auto Insurance & More For 100 Years. Get A Quote ....

Note: AAA auto insurance coverage is composed of several business throughout the United States, so options can differ in between regions. AAA auto insurance coverage is comprised of several business. vehicle insurance. CSAA Insurance Policy Group, the Auto Club Group, and Automobile Club Enterprises Insurance Policy Team are a few of the bigger companies that are component of the AAA auto insurance coverage umbrella.

Nonetheless, this suggests solution can vary by area. In AAA insurance policy reviews, lots of customers appreciate that they can collaborate with insurance representatives over the phone rather of with an application or via e-mail. While AAA car insurance coverage may not be available in some postal code, it can be one of the finest automobile insurance policy options if it's readily available to you.

For 24-year-olds, that boosts to $2,363 annually. Prices can surpass $3,000 each year for motorists with extremely poor credit scores or major driving convictions. That said, costs can also vary extensively depending upon the business you pick as well as other elements. While each firm calculates the rate of its policies differently, below are a few standard variables to consider:: This is among one of the most significant factors in the price of your automobile insurance policy.